Mastering Payments with an Invoice Format with GST

Managing payments efficiently is a cornerstone of maintaining robust financial health for any business. One critical component of this process is creating an invoice format with GST. This guide will walk you through the steps to craft an invoice format with GST and seamlessly add payments.

Why an Invoice Format with GST is Essential

An invoice format with GST is more than just a bill—it’s a compliance tool. It ensures that every transaction is documented in accordance with tax regulations. This not only fosters transparency but also streamlines the auditing process.

Steps to Create an Invoice Format with GST

- Header Section

- Your Business Name: Display your business name prominently.

- Business Address: Provide your full business address.

- GSTIN: Include your GST Identification Number (GSTIN).

- Invoice Number: Assign a unique number to each invoice.

- Invoice Date: Record the date the invoice is issued.

- Recipient Details

- Client’s Name: Add the client’s name.

- Client’s Address: Provide the client’s address.

- Client’s GSTIN: Include the client’s GSTIN, if applicable.

- Description of Goods/Services

- Item Details: List the goods or services provided.

- Quantity: Specify the quantity.

- Rate: State the rate per unit.

- Total Amount: Calculate the total for each item (Quantity x Rate).

- GST Details

- Taxable Value: Compute the taxable value.

- GST Rate: State the applicable GST rate.

- GST Amount: Calculate the GST amount (Taxable Value x GST Rate).

- Total Invoice Amount

- Subtotal: Add up the taxable values.

- GST Amount: Add up all GST amounts.

- Total Invoice Amount: Sum the subtotal and GST amounts.

- Payment Details

- Payment Terms: Define the payment terms (due date, late fees, etc.).

- Bank Details: Provide your bank account details.

- Payment Methods: List accepted payment methods (e.g., bank transfer, credit card).

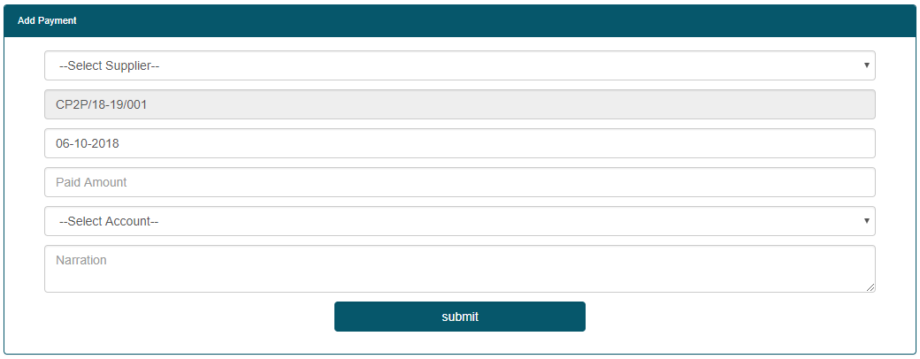

Adding Payments to an Invoice Format with GST

- Record the Payment:

- Once a payment is received, record it against the specific invoice number for accuracy in your invoice format with GST.

- Update the Invoice Status:

- Mark the invoice as “Paid” once payment is confirmed in your invoice format with GST.

- Generate a Payment Receipt:

- Issue a payment receipt to the client, detailing the invoice number, payment amount, payment date, and payment method in your invoice format with GST.

Benefits of Using an Invoice Format with GST

- Compliance: Ensures adherence to GST regulations, avoiding penalties with your invoice format with GST.

- Accuracy: Reduces errors through automated calculations in your invoice format with GST.

- Efficiency: Streamlines invoicing and payment processes, saving time with your invoice format with GST.

- Transparency: Provides clear transaction records, aiding financial planning and audits with your invoice format with GST.

Conclusion

Incorporating a well-structured invoice format with GST into your payment process is vital for any business aiming for efficiency and compliance. By following these steps, you can create accurate, transparent, and compliant invoices that streamline your financial operations. This not only ensures compliance with GST regulations but also enhances overall business efficiency with your invoice format with GST.

More Useful Link

- How to Add Payment in BharatBills

- How to Update Supplier in BharatBills

- How to Add Supplier Debit Note in BharatBills

- How to Add Supplier Credit Note in BharatBills

- How to Add Purchase Return in BharatBills

- How to Add Purchase Bill in BharatBills

- How to View//Update/Delete Purchase Bill in BharatBills