A Quick Overview of Proforma Invoice Under GST

What exactly a Proforma invoice is?

A proforma invoice is a prior bill of any sale that is sent to buyers in advance, describing the particular of goods and services. In other words it represents the price, shipping charges, weight, taxes and commissions etc. of a particular product.

Please note that Proforma invoices do not have an invoice number. These are those invoices that are not completed yet, as it is sent before the actual delivery of goods. It just confirms the details of the sale such as price of the product, taxes, commission etc.

Who issues Proforma Invoice and why?

Proforma is issued by the supplier to the customers. The overall purpose of a proforma invoice is to run the sales process smoothly. It’s not a bill that demands payment but in actual it lets the customer know exactly what to expect at the time of delivery.

Proforma invoices are commonly used in imports and trade transactions. The proforma invoices are not mandatory to prepare but it is termed as one of the best practices of any business because it helps any supplier to achieve its customers faith.

As proforma invoices are not the final sale invoice, any changes can be made by the customers in shipment before the actual dispatch of goods. Proforma invoices develops a sense of clearity between supplier and the customers regarding the prices, taxes, units etc.

But preparing pro forma invoices first and final selling invoices afterwards is quite time consuming, isn’t it?

Well, Bharatbills is the solution to that!

When to use the proforma Invoice?

Proforma invoices are prepared for smoothening the delivery process, hence it is created right before the actual delivery of the goods. Some of the important points to note are:

-it should be very clear to the customer that it is a “proforma invoice” and not a GST invoice

-supplier should not treat a proforma invoice as account receivable

-buyer should not record it as a account payable

Proforma invoices would be highly useful, when a customer may change his mind related to what purchase he wants to make, the quantity of the products etc. proforma can help you compensate your losses if products are damaged in transit.

Proforma invoice is basically keeping the invoicing process simple and straightforward to cut down the admin work.

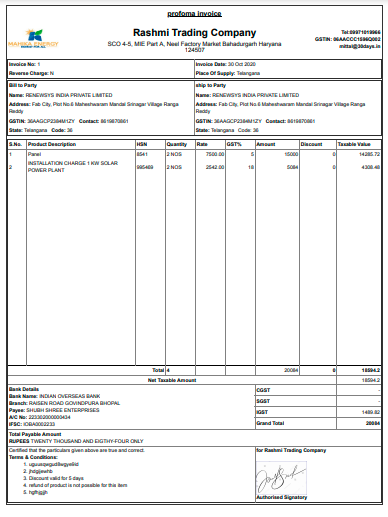

How a proforma invoice should look?

No law prescribes what should be the format of a proforma invoice, it might look similar to a sale invoice, but it’s the supplier’s responsibility to clearly state it as “proforma invoice”.

The Proforma Invoice Format generally include:

-Company’s name and address

-Reference number of the Proforma invoice

-Date of issue

-Buyer’s name and shipping address

-List of the products/services

-Quantities and price of each product

-Any applicable tax rates and the tax amount

-The total amount to be paid by the buyer

-Clear terms and conditions regarding the order, payment and delivery

People often confuse “Proforma invoice” with a “Invoice” both of these are different.

Proforma is the preliminary bill, whereas invoice is the final bill.

The purpose of the Proforma invoice is to help buyers in making the final decision, whereas invoice is to notify the customer for payment.

Create A Proforma invoice in BharatBills:

Along with the header “proforma invoice”, certain fields are included to understand the nature of the document. Here’s a quick guide to issue a proforma invoice in Bharatbills.

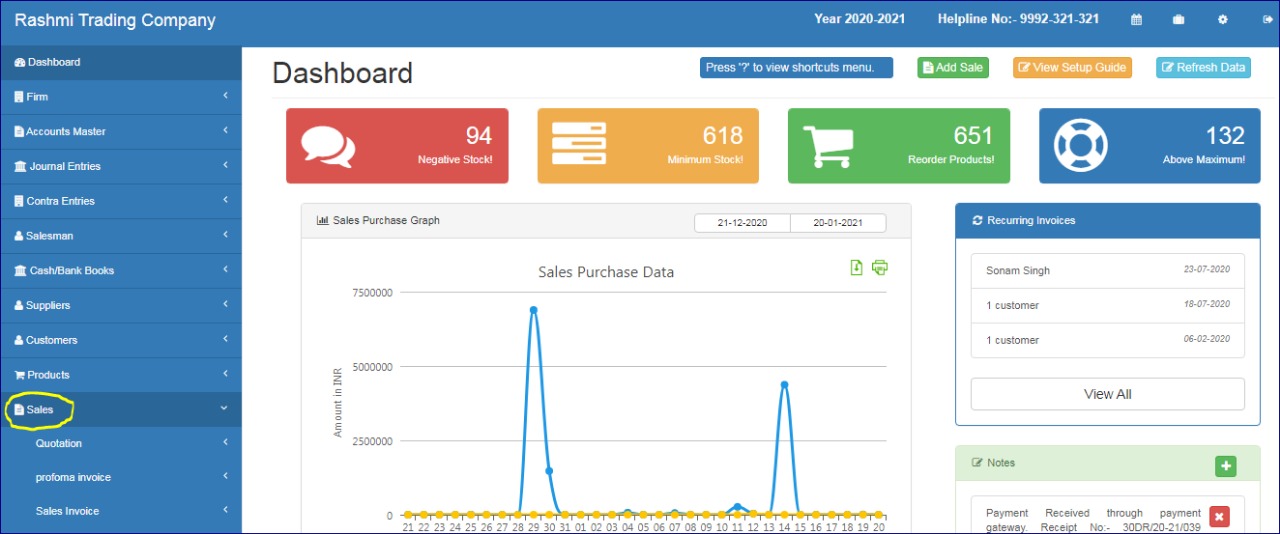

Step 1) Login to your Bharatbills account you’ll see your Dashboard

Step 2) Scroll down to “sales”

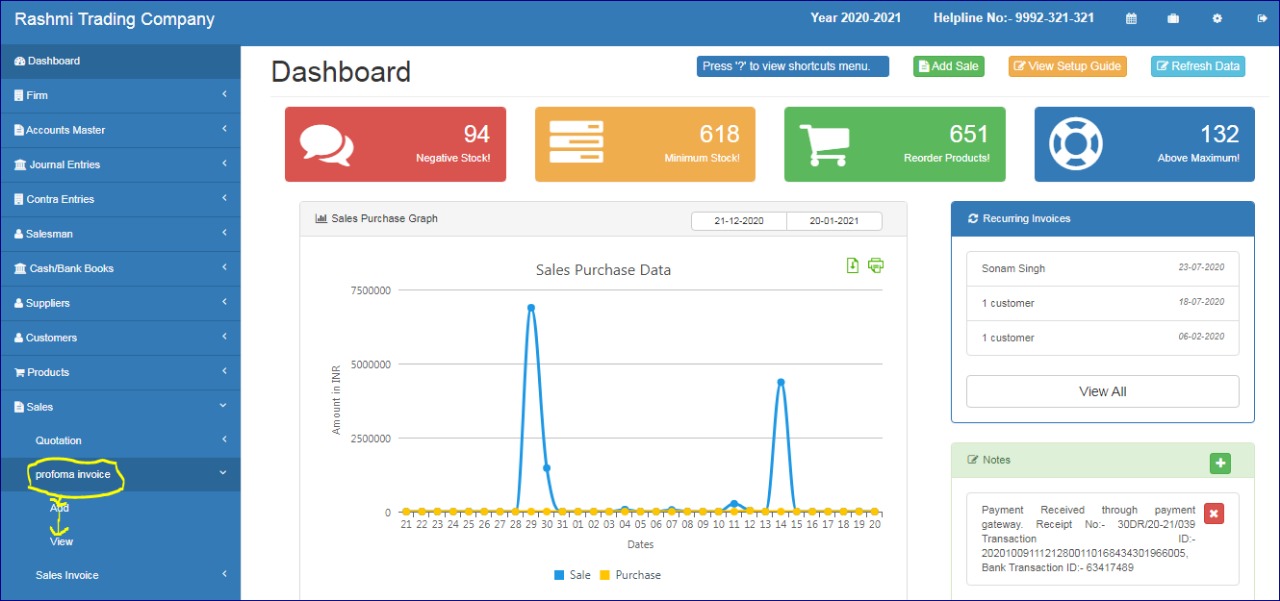

Step 3) You’ll see various columns such as Quotation, Proforma Invoice and Sales Invoice

Step 4) Click on Proforma Invoices

Step 5) Add or view Proforma It will literally take 5 of your seconds and generated Proforma Invoice.

Bharatbills is the best GST billing software in India at present. Easy to use, budget friendly and a complete solution to any billing problem.

Click Here For FREE GST Billing Software DEMO.