A Quick Overview of Proforma Invoice Under GST Billing Software

What exactly is a Proforma Invoice?

A proforma invoice in GST billing Software is a preliminary bill sent to buyers before the actual sale, detailing specifics like price, taxes, shipping charges, and commissions. Unlike a regular invoice, it doesn’t include an invoice number and is not a demand for GST payment. Instead, it outlines the sale details, allowing customers to review costs and make any necessary adjustments before final delivery.

Who Issues a Proforma Invoice and Why?

Suppliers issue proforma invoices to customers to clarify the terms of sale and ensure a smooth transaction. Common in imports and trade, proforma invoices IN GST billing software are not mandatory but are considered best practice. They help build trust between the supplier and customer, enabling adjustments to orders if needed before shipping.

When to Use a Proforma Invoice in GST Billing Software?

In Bharatbills (GST billing Software) Proforma invoices are issued before the actual delivery of goods to facilitate clarity. Key considerations include:

- Labeling: Mark it as a “proforma invoice” and not a GST invoice.

- Accounting: Suppliers shouldn’t treat it as an account receivable, nor should buyers record it as an account payable.

It’s useful when the customer may change order details, as the proforma helps prevent losses in transit. Essentially, proforma invoices simplify the invoicing process, reducing administrative tasks.

How Should a Proforma Invoice Look in GST Billing Software?

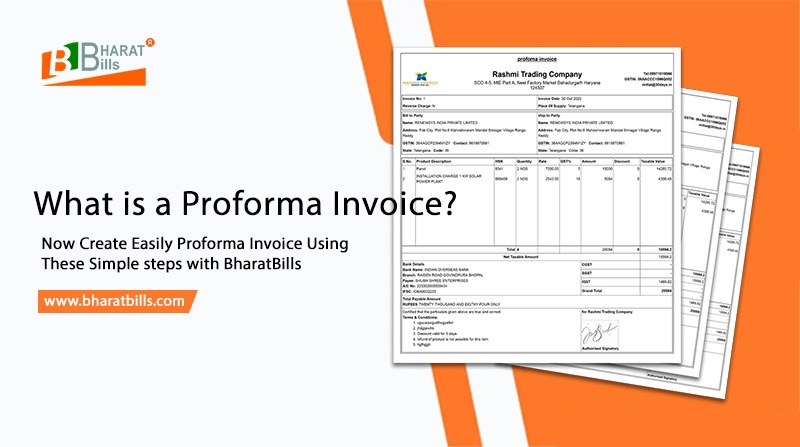

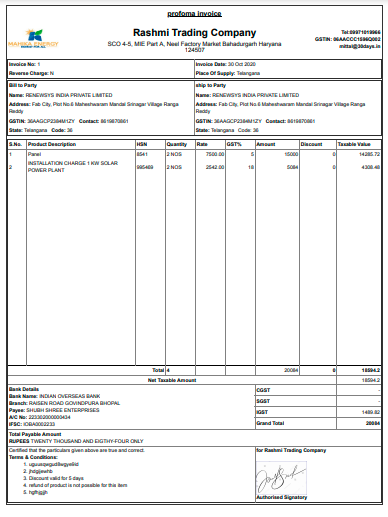

While there’s no specific legal format for a proforma invoice in GST billing software, it should be marked as such to avoid confusion. A standard proforma invoice in GST billing software format generally includes:

Terms for order, payment, and delivery

Company name and address

Proforma invoice reference number

Issue Date

Buyer’s name and shipping address

Product list, quantities, and prices

Applicable tax rates and amounts

Total payable amount

Create a Proforma Invoice in GST billing Software

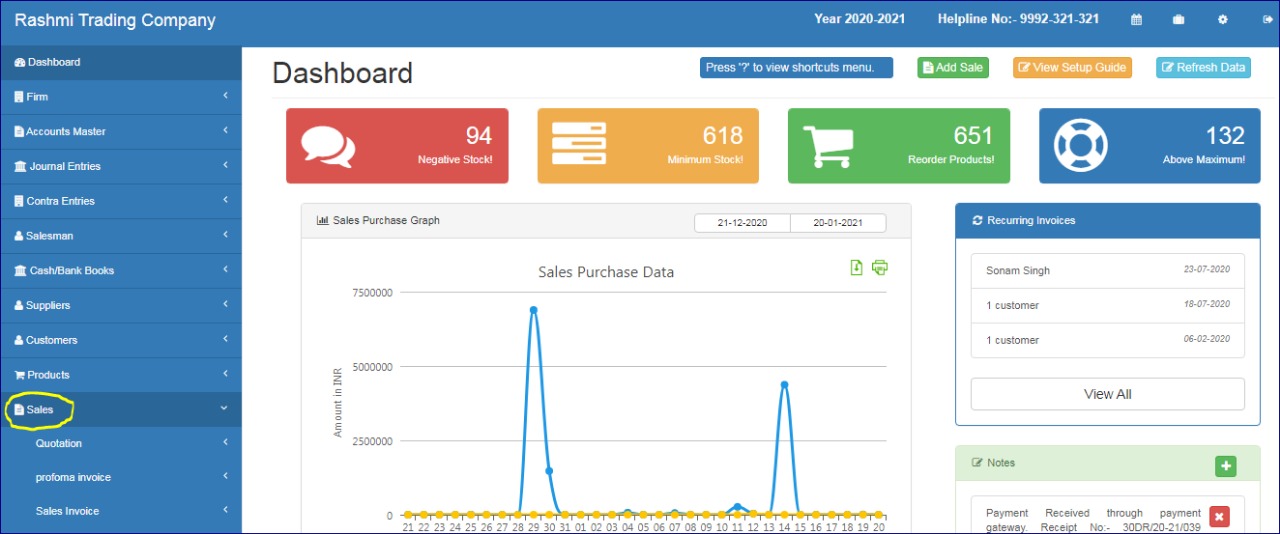

BharatBills, India’s top GST billing software, simplifies proforma invoice creation. Here’s a quick guide:

Step 1) Log in to BharatBills (GST billing software) and go to the dashboard.

Step 2) Scroll to “Sales.”

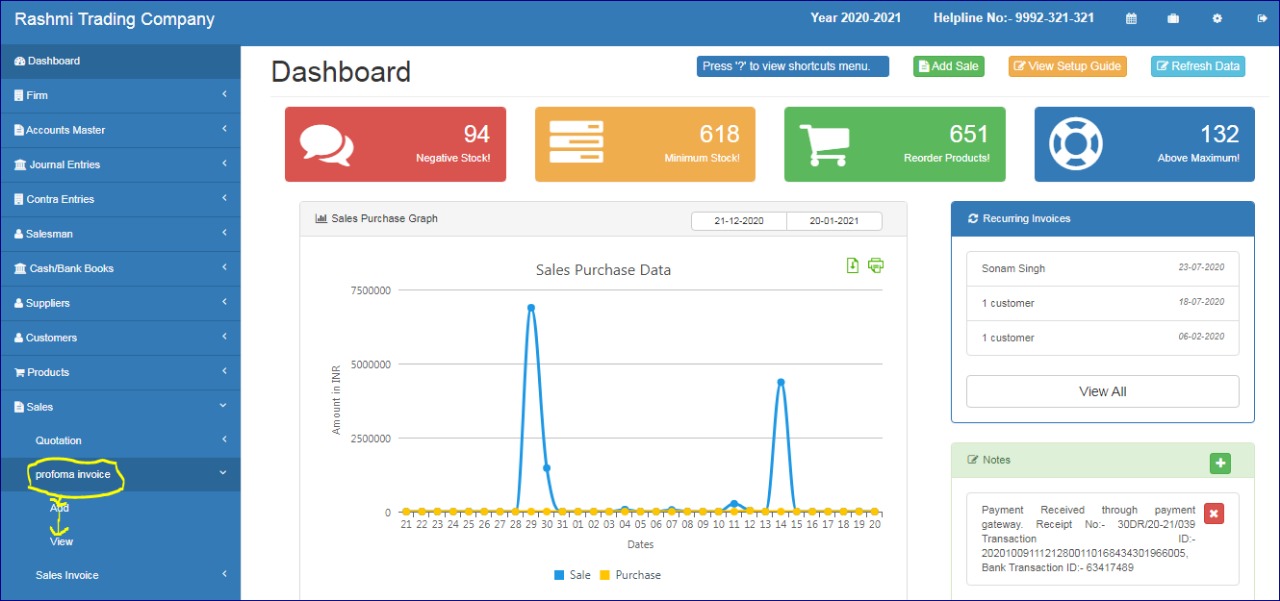

Step 3) Select Proforma Invoice from the options.

Step 4) Click on Proforma Invoices

Step 5) Add or view Proforma It will take 5 of your seconds and generate a Proforma Invoice.

Bharatbills is the best GST billing software in India at present. Easy to use, budget-friendly and a complete solution to any billing problem. With BharatBills, India’s best GST billing software, managing billing is efficient, cost-effective, and reliable.

Click Here For FREE GST Billing Software DEMO.