What is GST (India)? – A Complete Guide

GST will not scare you anymore because we are going to tell you all that you need to know about Goods & Service Tax by sharing a complete guide, its history, advantages, and the new GST compliance. Keep reading the article if you want to know the origin of GST and its journey till now.

In this article, we take a closer look at what is GST and the reason why it is making business and taxes simpler and easier

- What is GST in India?

- History of GST

- The purpose of bringing GST in India?

- Advantages Of GST

- Tax laws before the introduction of GST

- List of Taxes before GST

- How has GST reduced the price?

- What are the new compliances under GST?

- What are the benefits of the GST structure?

What is GST in India?

An indirect tax known as goods and services tax has eliminated the need for all the other indirect taxes in India, such as VAT, excise duty, etc. Goods & Service Tax was passed in 2017 on 29th Mar and came into existence from 1st July of 2017.

Goods & Service Tax is levied on every value addition, in general words, it is levied on the supply of goods and services. A single indirect tax for the entire country made the taxation system a lot easier and more effective. The tax is levied on every type of sale whether it is inter-state or intra-state. Central GST or SGST is levied on inter-state sales whereas IGST is levied on intra-state sales.

GST is a multistage tax charged on value addition

GST is a multi-stage tax which means it is charged at every stage of the sale from purchasing raw materials to selling them to the customers. In other words, Goods & Service Tax will be charged for purchasing raw materials, manufacturing, selling it to wholesalers, selling it to retailers, and the final sale to the customers. Each value addition is subject to Goods & Service Tax, which means if you buy raw materials and mix them up together the Goods & Service Tax will be charged on the final output. Let’s understand it better with the help of an example.

Suppose you are a Baker, you purchase flour and sugar for baking a cake, you put it together, and the GST will be charged on the baked cake. Now you’ll pass the cake to wholesalers who’ll package it as required, the GST will be charged on these value additions.

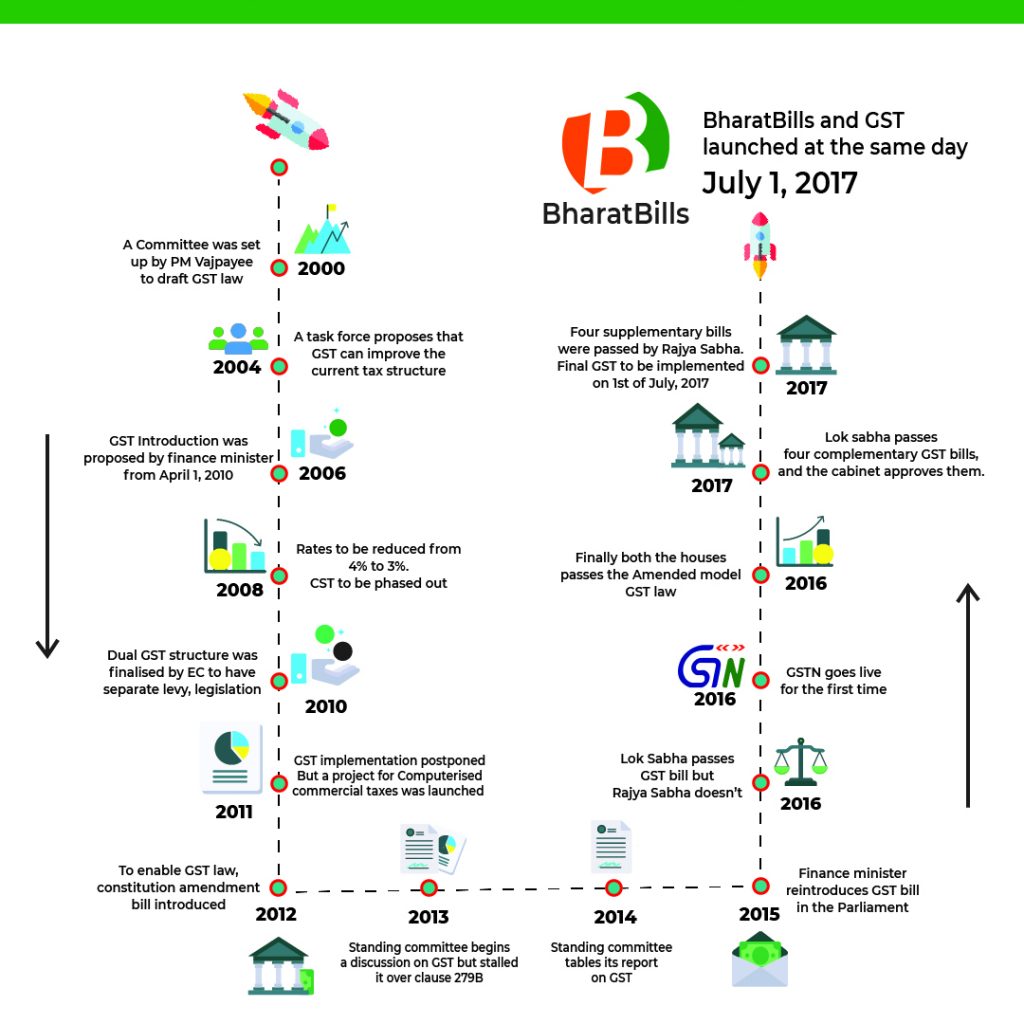

History of GST

GST came into the lights on 1st July 2017. It took 17 long years to frame a law, the actual journey of GST began when a committee decided to draft the law, and finally, the Goods & Service Tax was passed in the Lok Sabha and the Rajya Sabha.

PM Vajpayee was the one to set up the committee for drafting the law in the year 2000. Further, in 2004 it was concluded that the Goods & Service Tax must be implemented to improve the current tax Scenarios. Years passed by and new amendments were made to the GST then finally GST was implemented on the 1st of July 2017. Check out the image below to know the years and the amendments briefly.

The purpose of bringing GST in India?

Goods & Service Tax eliminated the need for each and every indirect tax that was charged on goods and services by the central and state governments of India.

The government decided to bring the taxation system under a single roof named GST which further removed the cascading effects of taxes on the prices of goods and services.

Advantages of GST

- The major benefit from GST was the removal of the cascading effect on the sale. Let’s help you understand what the cascading tax effect is.

- A cascading tax effect is “tax on the tax”. A customer has to bear the tax on the tax and higher prices as a result.

- Since the cascading effect was eliminated with the help of Goods & Service Tax, the prices of the goods also came down.

- GST also helped in bringing uniformity in tax processes and allowed centralized registration.

- Small business owners found it quite easy to file tax returns every quarter online.

- GST benefited the economy in many ways such as we experienced increased investments and employment with the introduction of Goods & Service Tax.

- It further helped us in taking our “Make in India” Initiative a step forward.

Tax laws before the introduction of GST

Earlier there were many indirect taxes that were charged on the goods and services by central and state governments. Every state had a different set of rules and majorly collected tax in the form of VAT.

Interstate sales of goods were taxed by the central government and the tax CST was charged on it. There were taxes like entertainment tax, local tax, etc. Both were charged together by the central and state governments which resulted in the overlapping of taxes. Let us better understand with the help of an example,

When goods were manufactured, an indirect tax named excise duty was charged by the central government, and further VAT was charged by the state government which resulted in a tax on tax also known as the cascading effect as discussed above.

List of Taxes before GST

- Central Excise Duty

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Entry Tax

- Duties of Excise

- Purchase Tax

- Central Sales Tax

- Cess

- State VAT

- Luxury Tax

- Entertainment Tax

- Taxes on advertisements

- Taxes on lotteries, betting, and gambling

Thankfully, the Goods & Service Tax has removed the need for all the taxes mentioned above.

Certain Taxes charged for Interstate purchases at a rate of 2% by the issue and utilization of ‘Form C” is still prevalent.

It applies to the following non-Goods & Service Tax goods:

- Diesel

- Petroleum

- Natural gas

- Liquor

This applies to the following transactions only:

- Used in manufacturing processes

- Telecommunications, mining, or any other power sector

- Resale

How has GST reduced the prices?

As we already know, during the pre-Goods & Service Tax period, we as purchasers were paying the tax. In other words, we were paying the tax on every additional value which is known as the cascading effect as discussed above. With the introduction of Goods & Service Tax, we experienced uniformity in our taxation. Goods & Service Tax basically integrated the whole country with a uniform tax rate which further improved the collection of taxes and enhanced the economic development of India by removing all non-relevant indirect taxes.

Due to the cascading effect, the burden of high prices is ultimately faced by the customers as the final consumption of the products is made by the customers.

Whereas in the present Goods & Service Tax regime, the tax is paid at a predefined rate. There’s a way to claim the paid tax credit. In simple words, any individual who paid the tax already can claim credit for the already paid tax at the time of filing GST returns.

The sale price is reduced every time an individual claims the tax credit which further allows the customer to bear lower prices because of reduced tax liability. As a result, customers felt a reduced burden right after the implementation of Goods & Service Tax.

New compliance under GST?

Filing Goods & Service Tax online is the biggest win for every business owner as you don’t have to get confused with various taxes apart from GST. There are several other new GST regimes that has been introduced, let’s discuss them below:

Eway bills

A centralized system of Waybills under the name “E-way bills” By Goods & Service Tax was launched on 1st April 2018 for interstate sales and from 15th April onwards for intrastate sales. Under this system, the manufacturer or trader can simply generate e-way bills for the goods that are transported from one place to another, smoothly. This system helped tax authorities greatly as this eliminated tax evasion.

E-invoicing

The e-invoicing system is very familiar to everyone around these days. It was made applicable from 1st October 2020 for businesses with a turnover of more than ₹500 crores in the preceding financial years. The system is finally made available for everyone with a turnover of more than ₹100 crores.

The business has to necessarily get a unique IRN (invoice reference number) for every B2B invoice by uploading it on the GSTN portal. The portal further authenticates the realness of the invoice and authorizes it with a digital signature and QR.

E-invoicing helps you reduce data entry errors as the invoices are operated on their own. It is specifically designed to pass the details from IRP to GST and e-way bill portals effortlessly eliminating the need for manual data entries while filing GSTR-1.

What are the benefits of the GST structure?

The structure of the Goods & Service Tax model is pretty similar to that of the Indian Government. The structure of Government is a dual model, meaning it has ministers on both ends, state, and center. This same arrangement can be seen in the case of GST as well. Due to this similarity, both governments will excise GST synchronously.

Let us look at the four sections in which Goods & Service Tax is implemented:

IGST – Integrated Goods and Service Tax

CGST – Central Goods and Service Tax (CGST)

SGST – State Goods and Service Tax

UGST – Union Territory Goods and Service Tax

In contrast with the Service Tax Act 1994, GST is one of the biggest tax reforms introduced by GST because it covers the entire nation, including Jammu and Kashmir. Now we will see what all these four sections are:

CGST

CGST or the Central Goods and Services Tax is a tax imposed by the central government on local goods and services provided within the state. CGST is the first tax to be set off against, followed by the IGST input tax credit only as a second. The Central Government shall transfer the amount collected under CGST. A product or service’s Central Goods and Services Tax rate will be equal to its Special Goods and Services Tax rate.

SGST

SGST or State Goods and Services Tax applies to both goods and services provided within a state. In the case of SGST, the taxable amount will be offset first by the SGST or UTGST, then the remaining amount can be set off against the IGST input tax credit. State governments use the tax collected under SGST to run their operations. CGST rate for a particular product or service shall equal the State Goods and Services Tax rate.

UTGST

UTGST or Union Territory and Service Tax is a tax on intrastate goods and services imposed by the Government of Union Territory. First, the UTGST is offset by the IGST input tax credit. The balance is offset by the UTGST. As with the SGST, this tax also has the same concept but is only applicable in India’s Union Territories instead of the rest of the country. The government of the Union Territory gets the amount collected under UTGST. In the Union Territory, the Goods and Services Tax rate on a particular product or service shall be equal to the CGST rate.

IGST

IGST or Integrated Goods and Services Tax is imposed by the Central Government and is excised on both services and goods outside the state, unlike other taxes, in other words, interstate imports. The tax owed under IGST will be offset against the IGST in the first instance with the remainder being set off against CGST and then against SGST/UTGST input tax credit. IGST is collected by the Central Government and then shared with the rest of the state governments.

For more information read or check out our articles:

Top 5 Billing Software for Businesses in 2023